AI data privacy is the set of security measures taken to protect the sensitive data collected, stored, and processed by AI apps, frameworks, and models.

Reducing risk with secure generative AI strategies

AI has become a game-changer for banks and financial institutions. Generative AI (GenAI) and Large Language Models (LLMs) offer immense potential for analyzing vast amounts of data, automating complex tasks, and enhancing customer experiences through personalization and efficiency. But these advancements also introduce serious AI data privacy risks that can’t be overlooked.

As AI technologies integrate deeper into financial services, they process and store substantial amounts of Personally Identifiable Information (PII) and other sensitive data. But making confidential information more accessible also increases the risks related to data breaches and unauthorized access. Additionally, financial service providers must comply with data privacy laws, like CPRA, GDPR, and HIPAA, or risk financial losses and reputational damage.

This article offers strategies for financial service providers to secure AI data and bridge the consumer trust gap.

How financial institutions can leverage GenAI today

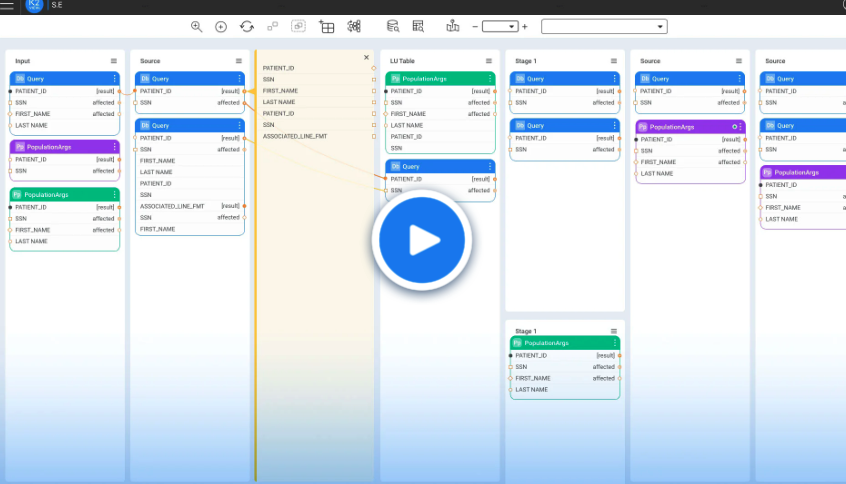

The potential of generative AI to transform customer operations in financial institutions is best exemplified through frameworks like Retrieval-Augmented Generation (RAG). RAG injects trusted enterprise data into your LLM enabling more precise and personalized responses to user queries.

For example a RAG chatbot providing accurate and contextual answers to a customer’s questions would dramatically reduce the time spent on calls and increase customer satisfaction.

Active retrieval-augmented generation also facilitates:

-

Fraud detection, by identifying suspicious activities in real time by analyzing transaction patterns and flagging anomalies that may indicate fraudulent behavior.

-

Risk management, by assessing credit risks more accurately by processing large datasets securely, allowing for more informed lending decisions and portfolio management.

-

Automated data encryption, by ensuring that information is protected both at rest and during transmission without requiring manual intervention. This automation reduces the risk of human error and enhances the overall security posture of the institution.

But how do you leverage GenAI data without compromising on privacy and security?

AI data privacy risks in the financial sector

While AI offers numerous advantages, it also introduces vulnerabilities that malicious actors are eager to exploit. In finance, where PII holds significant value, these risks can widen the customer trust gap.

Here are the top 4 AI data privacy risks:

-

Advanced threats, like jailbreaking or prompt injection, that bypass standard security protocols.

-

AI model vulnerabilities, that might reveal sensitive training data or derail AI prompt engineering efforts.

-

Regulatory non-compliance, which could lead to hefty fines and legal action.

-

Loss of customer trust, which is difficult to rebuild and could have a long-term impact on the business.

Defending against these vulnerabilities is essential for safeguarding sensitive information and maintaining trust.

Enhancing AI data privacy to close the trust gap

To counter these risks, financial service providers have to establish robust AI data privacy strategies bolstered by proven data masking techniques. Demonstrating a commitment to consumer safety not only protects your institution but also promotes customer trust.

Key components of a viable AI data privacy strategy should include:

-

Data encryption, to obscure your sensitive data at rest or in transit.

-

Access controls, to ensure that only authorized users can view or modify PII.

-

Data masking, to hide personal identifiers in training and production datasets.

-

Adversarial strategizing, to protect your AI model against malicious attacks.

-

Data risk assessments, to identify vulnerabilities, and implement safeguards.

-

Privacy compliance, to adhere to all relevant data privacy laws and standards.

-

Data minimization, to store only the data that’s truly needed.

-

Regular monitoring, to quickly detect any unusual behavior or security issues.

-

Training, to educate users about the risks of GenAI and how to contain them.

How RAG enhances LLM accuracy and AI data privacy

A RAG architecture enhances the performance of your enterprise LLM by integrating your private, internal company data, resulting in AI responses that are more accurate, personalized, and context-aware.

A centralized data lake, today’s most common form of big data storage, isn’t a good fit for GenAI data because it:

-

Contains sensitive information, which could be leaked.

-

Costs a lot, in terms of cleansing and querying data.

-

Struggles to deliver AI-ready data, that’s clean, compliant, and current.

The ideal solution is Micro-Database™ technology, which creates a mini data lake for each customer, employee, or product. Micro-Databases continuously sync individual entity data with source systems, enforce data privacy rules, and apply AI data quality standards automatically. Deploying millions of these tiny data stores allows financial institutions to deliver AI personalization at the scale and speed of business while maintaining the most stringent security measures.

If you’re a data pro in the financial services sector, going micro can be transformational. By injecting real-time enterprise data into your LLM, you can enhance transparency, bridge the trust gap, and improve customer experiences without compromising on AI data privacy or AI data quality.

Conquering AI data privacy challenges with K2view

Incorporating RAG GenAI into the field of financial services offers significant benefits, but it also poses AI data privacy challenges that must be addressed proactively. By first understanding the risks and then implementing advanced RAG tools, like GenAI Data Fusion by K2view, you’d benefit from Micro-Database technology with AI data privacy built-in.

Effectively tackling the challenges of AI data privacy not only helps you protect your enterprise data and reputation, but it also helps to enhance transparency, bridge the trust gap, and elevate the user experience.

Learn more about GenAI Data Fusion by K2view,

the suite of RAG tools that puts AI data privacy first.